Be sure to Notice that Strong Tower Associates and its affiliates never give legal or tax information. You might be inspired to consult your tax adviser or lawyer.

Every retirement account includes its own tax benefits, and what sets the Roth IRA apart is tax-free withdrawals in retirement.

Opening a brokerage account is the first step to buying stocks, bonds, mutual money as well as other investments.

Refinancing and equity guideToday's refinance ratesBest refinance lenders30-calendar year fixed refinance rates15-yr fastened refinance ratesBest cash-out refinance lendersBest HELOC Lenders

This variety will not be just for demonstrate; it empowers you to definitely tailor your investments for your unique fiscal targets and chance appetite.

When you purchase via hyperlinks on our site, we may perhaps gain an affiliate commission. Below’s how it works.

The 3rd phase is your revenue distribution stage as you devote down your property and enjoy retirement, but the outcome of People four to five years inside the retirement hazard zone can drastically affect that third phase.

The attract of a Roth IRA lies in its promise of very long-term tax personal savings and unfettered use of your money.

But in case you personal a conventional IRA, you have to acquire your check here initial demanded minimal distribution (RMD) by April one of the yr next the year you get to RMD age.

Very best IRA accountsBest on the internet brokers for tradingBest on the internet brokers for beginnersBest robo-advisorsBest choices investing brokers and platformsBest trading platforms for day investing

Certified distributions are permitted at age fifty nine½, but an exception could assist you to create a penalty-no cost withdrawal

Sure, there might be a ten% penalty in case you withdraw funds early from your Roth IRA, but only if you are withdrawing out of your earnings (the money that your money has acquired in curiosity from becoming invested) instead of your contributions (the money you actually set to the account).

Some parameters to guidebook your final decision about an early Roth IRA withdrawal could include the amount of you believe You'll have, regardless of whether you happen to be qualified for an experienced or non-capable withdrawal, and estimating just what the taxes and penalties (if any) may be if you plan to get out earnings.

This balancing act involving making the most of your retirement earnings and maintaining favorable tax ailments is the place strategy fulfills savvy monetary scheduling.

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Yasmine Bleeth Then & Now!

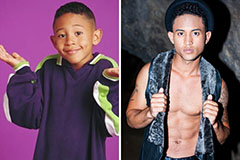

Yasmine Bleeth Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now!